Winner of the Florida Book Awards Gold Medal

THE HIDING PLACE WAS JUST THE BEGINNING!

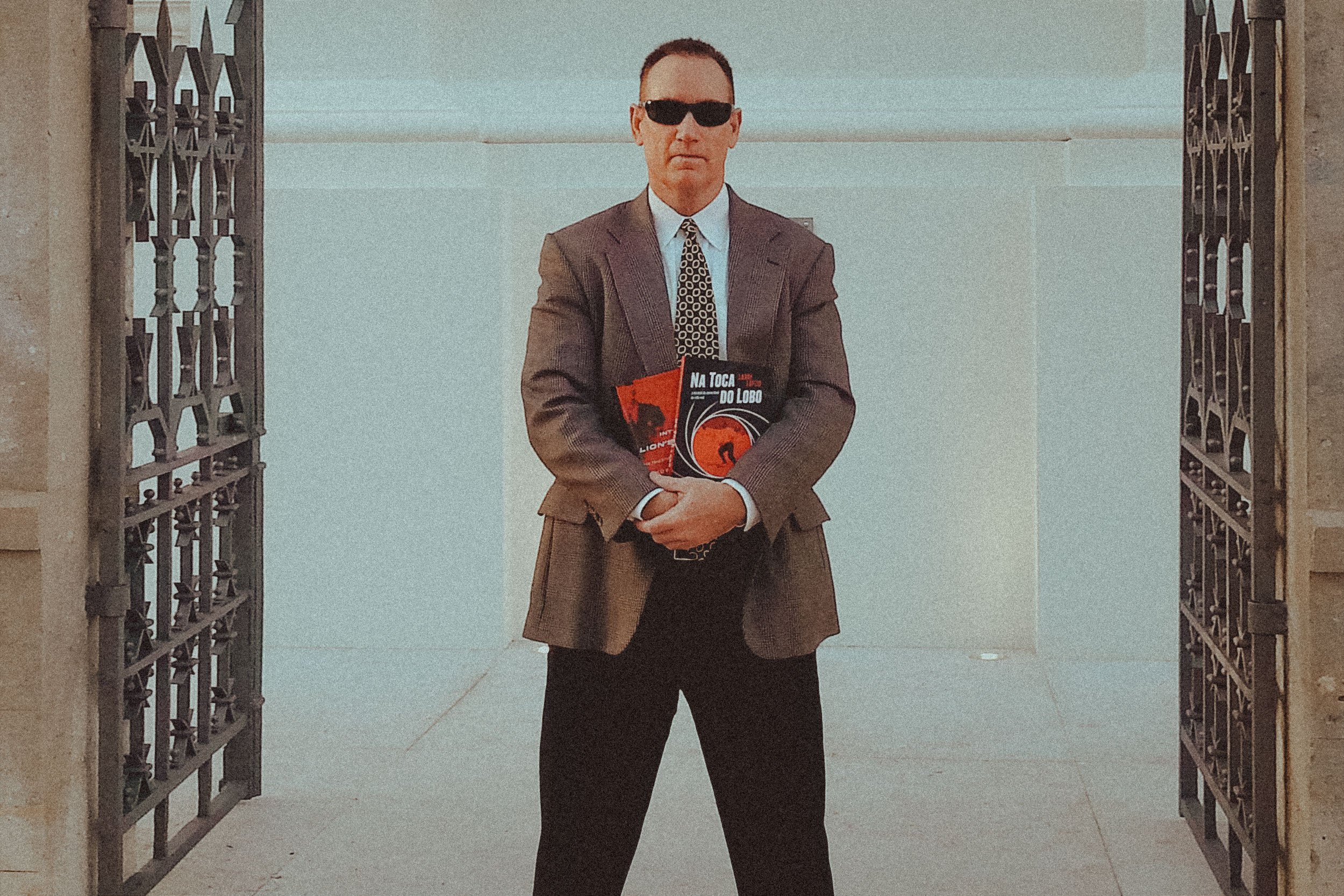

NEW YORK TIMES AND INTERNATIONAL BESTSELLING AUTHOR OF NONFICTION THRILLERS

LARRY ON HUCKABEE!

Larry’s appearance on HUCKABEE discussing Corrie ten Boom and THE WATCHMAKER’S DAUGHTER.

THE REAGAN LIBRARY!

Larry discusses THE WATCHMAKER'S DAUGHTER at the Reagan Library. WATCH HERE.

SUBSCRIBE

BLOG